Some regions of the country have organized, wholesale electric markets. When power plants produce electric energy in these regions, utilities and other energy providers purchase it in the energy markets and then resell it to consumers. Some regions (ISO-New England, ISO-New York, Midcontinent ISO, and PJM Interconnection) also have a capacity market to make the grid more reliable. A capacity market pays power suppliers for their commitment to meet future electricity needs. A capacity market does not pay for the energy produced but instead pays for the ability to produce power when needed.

The Auction Process

Capacity market auctions ensure enough electricity is available for future demand at the lowest achievable price for consumers. The goal is to balance reliability with cost by having market participants compete. There are two main types of auctions:

Forward capacity auctions: held years before the capacity is needed, giving operators time to upgrade or build facilities.

Incremental auctions: take place closer to the delivery time, adjusting for changes in demand or unexpected generator issues.

Generally, participants submit sealed bids to offer capacity at specific prices. The auction ends when the total capacity offered matches the region’s needs, and a single clearing price is set for all commitments.

These auctions encourage competition and fairness by being open to participation by new power plants or suppliers.

Capacity Obligations

Capacity Obligations have three main requirements:

Availability: providers must ensure their resources are ready and available to supply electricity (or reduce demand) whenever needed by the grid operator.

Performance: providers must deliver the full capacity they committed to during the auction.

Maintenance: providers must keep their facilities in good working order to meet their obligations.

The grid operator may require winning bidders to provide electricity—or reduce usage for demand response providers—during the agreed delivery period. To do this, grid operators regularly conduct audits and may perform periodic tests to prove participants can deliver the extra capacity if needed. Capacity markets are intended to promote fairness and ensure reliability by penalizing failures to meet the commitment to produce power when needed. In some instances, penalties may be waived for failures caused by natural disasters or other major and unforeseeable events. Some markets also pay more to participants who deliver power beyond their capacity obligations.

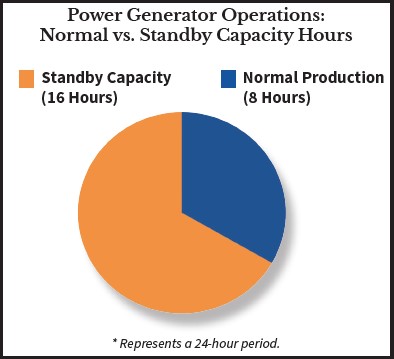

In the chart to the left, a power generator is paid for 8 hours of normal energy production (blue).

In a capacity market, the power generator can also be paid to stand by to deliver additional power, if necessary (orange).

The generator will also be paid for any additional power it is required to produce during those standby hours.

Market Participants

Capacity markets depend on various participants to ensure enough electricity is available for future demand, especially during peak times. These include:

- Power generators: produce electricity to meet demand.

- Demand response participants: reduce electricity usage in response to high-demand events.

- Energy efficiency providers: reduce electricity usage regularly, all the time or at key times.

- Energy storage providers: store electricity during off-peak periods and seek to deliver it during times of greater need.

- Utilities and load-serving entities (LSEs): purchase energy in the markets to fulfill their obligation to deliver electricity to consumers.

- Grid operators: do not buy or sell energy or capacity, but oversee both the electric grid and the markets to maintain transparency, stability, and reliability.

Power Generators

Generators don’t just sell electricity; they can also sell capacity, which is their commitment to be ready to produce power when needed. This helps grid operators ensure there’s enough power during high demand times, like hot summers or cold winters.

Range of generator types: coal, natural gas, hydropower, solar, wind, nuclear, and oil plants.

Peaker plants: generally, gas- or oil- fired, only run during peak demand. These plants are important because they can quickly start and stop producing electricity.

Generators take part in capacity auctions by bidding how much power they can provide (in megawatts) and at what price. If their bids are accepted, they earn payments for being available, even if they don’t produce electricity.

Grid Operators

Independent System Operators (ISOs) and Regional Transmission Organizations (RTOs) manage the electricity grid to ensure enough power is always available, maintain smooth operations and meet reliability standards. They run capacity auctions, forecast electricity demand and peak periods, and ensure the grid has enough capacity to prevent blackouts, especially during extreme weather or unexpected outages.

Utilites/Load-Serving Entities (LSES)

Utilities and LSEs pay capacity costs to generators and demand response participants based on prices set through capacity auctions. These costs are passed to consumers through electricity bills.

Investor-owned utilities (IOUs): for-profit companies serving large regions, often regulated by state commissions.

Municipal utilities: city or community-owned and often non-profit.

Electric cooperatives: member-owned utilities serving rural or small areas.

Retail electricity providers (REPs): buy electricity from the wholesale market in deregulated areas to sell to consumers.

Demand Response (DR) Program Participants

DR participants are usually paid to reduce energy usage during peak demand. When demand is high, programs encourage users like factories, commercial buildings, or smart homes to cut back temporarily to prevent brownouts and blackouts during extreme weather.

Demand response programs participate in capacity auctions by offering to reduce demand (in megawatts) during peak times, instead of using electricity. If their bids are accepted, they get paid for being ready to cut energy use, helping balance the grid without needing extra power plants.